What To Do If Your House Didn’t Sell

Last year, as many as 1 in 3 sellers took their home off the market because it wasn’t selling.

Last year, as many as 1 in 3 sellers took their home off the market because it wasn’t selling.

It’s no secret that affordability is tough with where mortgage rates and home prices are right now.

There’s one big mistake you need to avoid when you sell your house this year: setting your price too high.

Today, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives.

It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market.

Wondering what to expect when you buy or sell a home this year? Here’s what the experts say lies ahead.

There’s one essential step in the homebuying process you may not know a whole lot about and that’s pre-approval.

Are you hesitant to sell your house because you’re worried no one’s buying with rates and prices where they are right now?

Your credit score plays a big role in the homebuying process. It’s one of the key factors lenders look at to determine which loan options you qualify for and what your terms might be. But there’s a myth about credit scores that may be holding some buyers back.

According to Fannie Mae, only 32% of potential homebuyers have a good idea of what credit score lenders actually require.

That means two-thirds of buyers don’t actually know what lenders are looking for – and most overestimate the minimum credit score needed.

But the truth is, you don’t need perfect credit to become a homeowner. To see the average score, by loan type, for recent homebuyers check out the graph below:

There is no set cut-off score across the board. As FICO explains:

There is no set cut-off score across the board. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .”

So, even if your credit score isn’t as high as you’d like, you may still be able to get a home loan. Just know that, even though you don’t need perfect credit to buy a home, your score can have an impact on your loan options and the terms you’re able to get.

Work with a trusted lender who can walk you through what you’d qualify for.

If you want to open up your options a bit more after talking to a lender, here are a few tips from Experian and Freddie Mac that can help give your score a boost:

1. Pay Your Bills on Time

This includes everything from credit cards to utilities and other monthly payments. A track record of on-time payments shows lenders you’re responsible and reliable.

2. Pay Down Outstanding Debt

Reducing your overall debt not only improves your credit utilization ratio (how much credit you’re using compared to your total limit) but also makes you a lower-risk borrower in the eyes of lenders. That makes them more likely to approve a loan with better terms.

3. Hold Off on Applying for New Credit

While opening new credit accounts might seem like a quick way to boost your score, too many applications in a short period can have the opposite effect. Focus on improving your existing accounts instead.

Your credit score doesn’t have to be perfect to qualify for a home loan. The best way to know where you stand? Work with a trusted lender to explore your options.

Have you ever stopped to think about how much wealth you’ve built up just from being a homeowner? As home values rise, so does your net worth. And, if you’ve been in your house for a few years (or longer), there’s a good chance you’re sitting on a pile of equity — maybe even more than you realize.

Home equity is the difference between what your house is worth and what you owe on your mortgage. For example, if your house is worth $500,000 and you still owe $200,000 on your home loan, you have $300,000 in equity. It’s essentially the wealth you’ve built through homeownership. Right now, homeowners across the country are seeing record amounts of equity.

According to Intercontinental Exchange (ICE), the average homeowner with a mortgage has $319,000 in home equity.

The rise in home equity over the years can be credited to two key factors:

1. Significant Home Price Growth

Home prices have climbed dramatically in recent years. In fact, according to the Federal Housing Finance Agency (FHFA), over the past five years, home prices nationwide have risen by 57.4% (see map below):

This appreciation means your house is likely worth much more now than when you first bought it.

This appreciation means your house is likely worth much more now than when you first bought it.

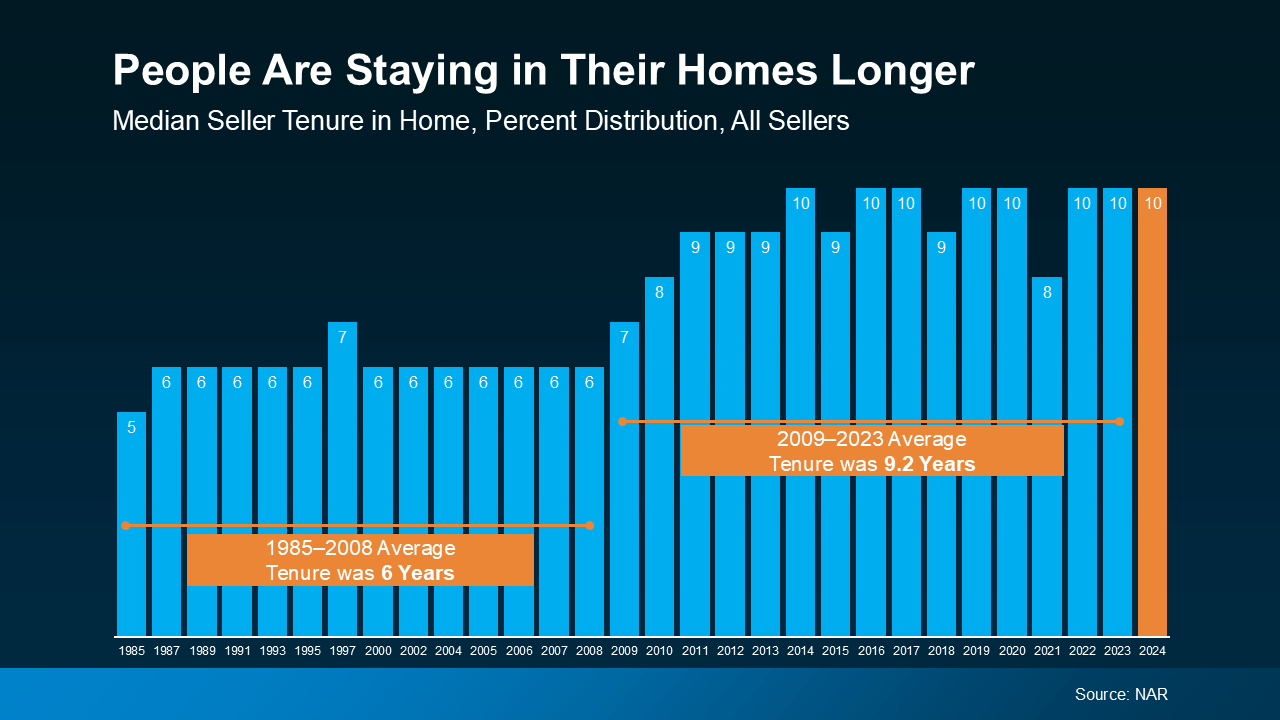

2. Longer Tenure in Homes

Data from the National Association of Realtors (NAR) shows people are staying in their homes for a decade (see graph below):

This increased tenure means homeowners benefit even more from home values growing over time. That’s because the longer someone has lived in their house, the more that home’s value has grown, which directly increases equity.

This increased tenure means homeowners benefit even more from home values growing over time. That’s because the longer someone has lived in their house, the more that home’s value has grown, which directly increases equity.

And if you’re one of those people who’s been in their home for 10 years or more, know this – according to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What does that mean for you? It means your house might be your biggest financial asset — and it could open up some exciting opportunities for your future. Let’s break it down.

Your equity could help you cover the down payment for your next home. In some cases, it might even mean you can buy your next house all cash.

Thinking about upgrading your kitchen, adding a home office, or tackling other projects? Your equity can provide the funds to make those improvements happen, increasing your home’s value and making it more enjoyable to live in too.

If you’ve been dreaming about starting your own business, your equity could be the kickstart you need. Whether it’s for startup costs, equipment, or marketing, leveraging your home’s value can help bring your entrepreneurial goals to life.

Whether you’re thinking about selling, upgrading, or simply want to understand your options, your home equity is a powerful resource. If you’re wondering how much equity you’ve built or how you can use it to meet your goals, connect with a local real estate agent to explore the possibilities.